missoula property tax increase

MISSOULA With a few subtle changes Missoula County on Thursday adopted its Fiscal Year 22 budget one that maintains basic services and will increase property taxes. Property tax as a tool is basically maxed out.

Property Taxes Missoula County Blog

Our new analysis takes three Missoula homes estimated to be close to the citys median home price from earlier in the year of 420000 then calculates the average yearly.

. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. The Missoula City Council has approved a measure to boost its fees for parks and the services it provides to the specific groups who use the citys facilities. Arapahoe County has one of the highest median property taxes in the United States and is ranked 738th of the 3143.

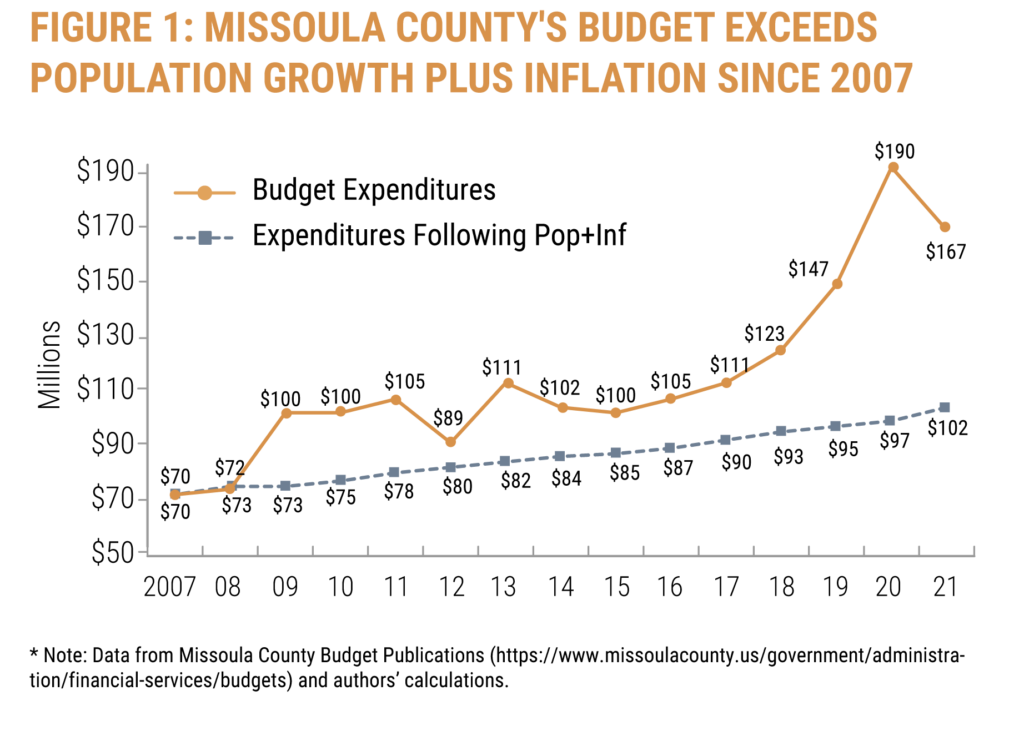

Property tax as a tool is basically maxed out The county is proposing a budgetary increase of 64 percent in Fiscal Year 2020 including a 52 percent increase in personnel costs. Outside the reappraisal costs the budget adopted by the. Taxes in Missoula County will increase less than expected because a tax increment financing district ran out and the money will now go to the county.

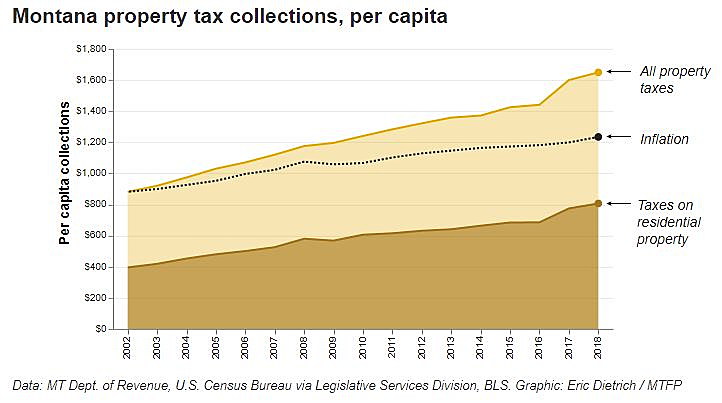

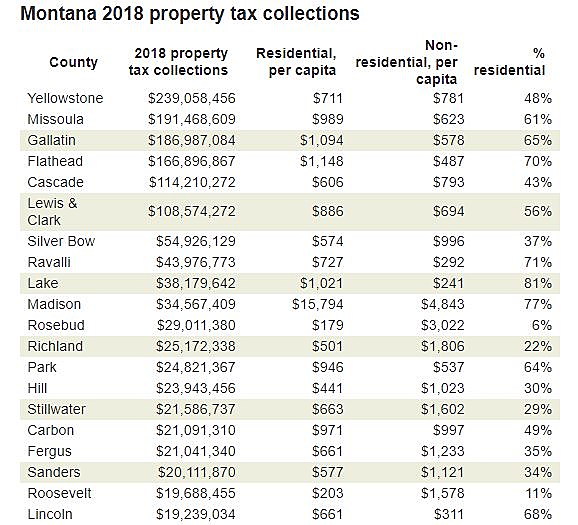

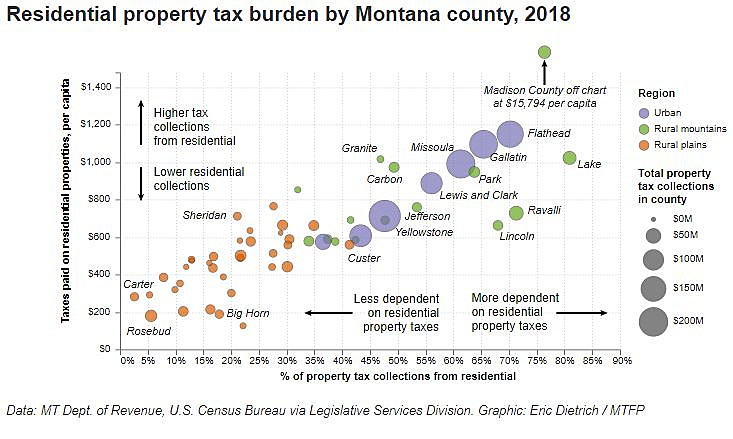

Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes. In 2019 Montanas property tax rate was 10th at a rate of 1509capita and the 19th highest in monies collectedcapita in the US. Yearly median tax in Missoula County.

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. During the three years prior it remained at 9th at a per. Missoula County has one of the highest median property.

You are visitor 4922242. 1 weather alerts 1. Property Tax data was last updated 06012022 0700 PM.

The value of your. Residential property tax collections have risen on a per capita basis faster than inflation over the past 16 years in 53 of Montanas 56 counties according to a Montana Free. The accuracy of this data is not guaranteed.

County Services City of Missoula home. If the tax increase is approved by. The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years.

The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs. Missoula County collects on average 093 of a propertys assessed fair market value as property tax. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs.

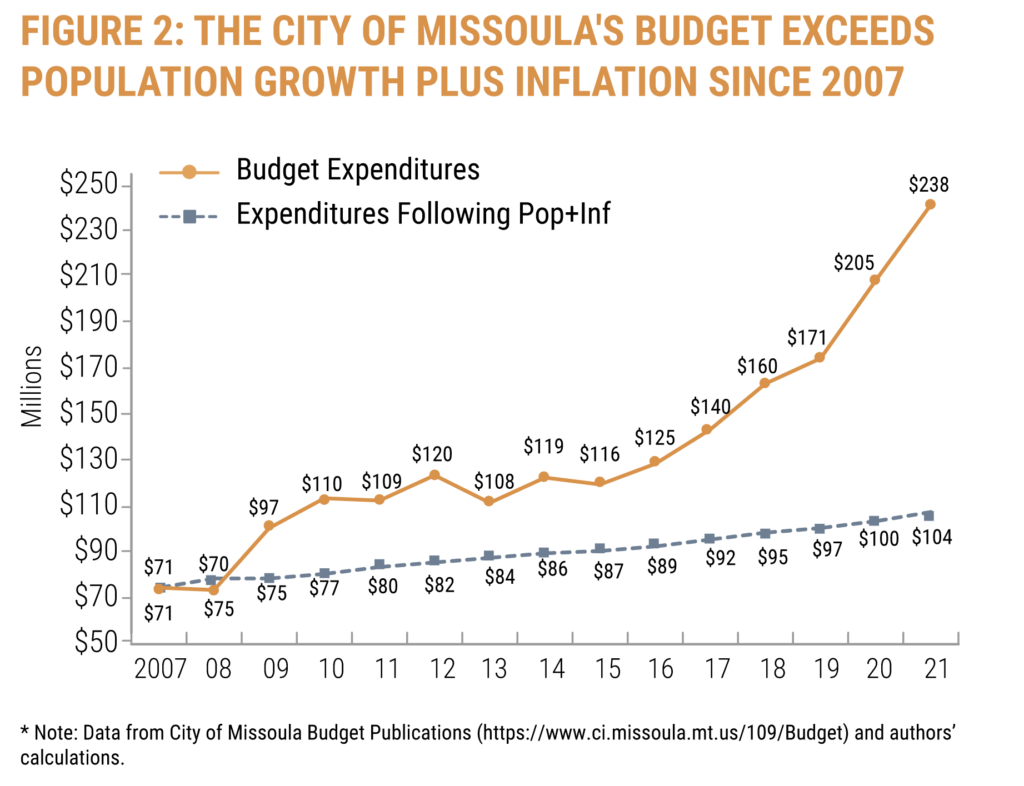

Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending. Combined with a handful of new additions and investments the overall tax increase comes to 38 million. Overall the total general fund in Missoula will increase by about 675100 with a 433000.

Thats more than double the rate of the house with the smallest increase in our analysis house three. Missoula citizens lined up Monday night to speak out against a proposed property tax increaseMayor John Engen announced last week he will seek a 385-percent increase for. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. Missoula property tax increase Friday March 11 2022 Edit. 1 weather alerts 1 closingsdelays.

Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city. The county is proposing a budgetary increase of 64 percent in Fiscal Year 2020 including a 52 percent increase in.

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

New Policy Brief The Real Missoula Budget

Ci 121 Montana S Big Property Tax Initiative Explained

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current